We have the tools and resources to help you start or

scale your business. Join our thriving community and

stay connected with us.

We have the tools and resources to

help you start or scale your business.

Join our thriving community and stay

connectedwith us.

Being an entrepreneur is hard, and having the proper resources can be frustrating. You do not have to go at it alone. We have courses and a community to help educate you (Real Life XP), a full CRM system to help you automate your processes (The Real Life Business Builder), and coaching to help you implement what you've learned.

Being an entrepreneur is hard, and having

the proper resources can be frustrating.

You do not have to go at it alone. We have courses and a community to help educate

you (Real Life XP), a full CRM system to help

you automate your processes (The Real

Life Business Builder), and coaching to help

you implement what you've learned.

We understand that minority entrepreneurs have different needs and we cater to those.

Real Life XP

Our flagship entrepreneur accelration course

covers the entreprenur mindset, developing

systems and processes for your business,

building credit and acquiring funding for your

business and much more.

Coaching and Consulting

The right guidance can help entrepreneurs

overcome obstacles or avoid them all together.

We offer one-on-one and group coaching

to guide entrepreneurs through the maze of

business building.

The Real Life Business Builder Community

Our free community for entrepreneurs offers

courses, eBooks, group coaching,

and other resources for the growth and

development of entrepreneurs.

The Real Life Business Builder

The Real Life Business Builder is a full CRM, marketing, and automation system that we help set up for our clients to ensure implementation. Our lowest plan is just $80 a month and includes a free website and basic automation set up.

Tax Preparation, Training,

and Software

Small businesses need tax preparers who

understand small businesses. We now offer tax preparation services, tax preparation training,

and tax software to ensure entrepreneurs are able to plan for taxes and receive maximum returns.

Business Credit and

Business Funding

Without capital, your business will not be able to grow. We help clients start from nothing and build business credit in less than 90 days. We also ensure that you fit the criteria to apply for different business funding options.

The Ultimate Business

Builder Blueprint

Let us help you create an irresistible offer,

a professional funnel to generate leads,

marketing and ads to increase your reach,

CRM software to manage leads, and coaching

to put it all together.

We understand that minority

entrepreneurs have different needs

and we cater to those.

Real Life XP

Our flagship entrepreneur accelration course covers the entreprenur mindset, developing systems and processes

for your business, building credit and acquiring funding for your business and much more.

Coaching and Consulting

The right guidance can help entrepreneurs

overcome obstacles or avoid them all together. We offer one-on-one and group coaching to guide entrepreneurs through the maze of business building.

The Real Life Business

Builder Community

Our free community for entrepreneurs offers courses, eBooks, group coaching,

and other resources for the growth and

development of entrepreneurs.

The Real Life Business Builder

The Real Life Business Builder is a full CRM, marketing, and automation system that we help set up for our clients to ensure implementation. Our lowest plan is just $80 a month and includes a free website and basic automation set up.

Tax Preparation, Training,

and Software

Small businesses need tax preparers who

understand small businesses. We now offer tax preparation services, tax preparation training,

and tax software to ensure entrepreneurs are able to plan for taxes and receive maximum returns.

Business Credit and

Business Funding

Without capital, your business will not be able to grow. We help clients start from nothing and build business credit in less than 90 days. We also ensure that you fit the criteria to apply for different business funding options.

The Ultimate Business

Builder Blueprint

Let us help you create an irresistible offer,

a professional funnel to generate leads,

marketing and ads to increase your reach,

CRM software to manage leads, and coaching

to put it all together.

Scaling With Leverage: How Credit & Capital Fuel Growth Without Killing Cash Flow

Introduction: Growth Slows When You Rely Only on Cash

One of the biggest myths in entrepreneurship is that the safest way to grow is to use only your own money.

While bootstrapping can work in the beginning, it becomes a silent ceiling as the business grows. Cash-only growth forces entrepreneurs to choose between opportunities, delay expansion, and absorb risk personally.

👉 Scaling requires leverage — and leverage requires access to capital.

In the Real Life XP framework, the Credit & Capital Pillar exists to help entrepreneurs grow strategically, not emotionally. This pillar is about learning how to use financial tools correctly so growth accelerates without destabilizing cash flow or increasing personal stress.

The Difference Between Revenue and Leverage

Revenue is what your business earns.

Leverage is what your business can access.

Many entrepreneurs generate revenue but lack leverage. When opportunities arise — larger contracts, bulk inventory, marketing pushes, hiring needs — they don’t have the capital to move quickly.

Without leverage:

Growth is slow

Decisions are reactive

Cash flow stays tight

Risk is concentrated on the owner

Leverage allows businesses to act before cash shows up — not after.

Why Self-Funding Becomes a Scaling Problem

Self-funding feels responsible. It avoids debt and feels “safe.”

But in reality:

It limits speed

It drains reserves

It increases personal risk

It forces trade-offs that stall momentum

Scaling entrepreneurs understand that cash is a tool, not a moral position. The goal isn’t to avoid credit — it’s to use it intelligently.

Business Credit vs Personal Credit

One of the most common mistakes entrepreneurs make is funding business growth with personal credit.

This leads to:

Higher personal risk

Lower personal credit scores

Limited funding capacity

Blurred financial boundaries

Business credit creates separation.

Properly built business credit:

Protects personal assets

Increases funding limits

Builds business credibility

Unlocks better terms over time

Scaling requires treating the business as its own financial entity.

Why Banks Don’t Fund Chaos

Access to capital is not just about credit scores — it’s about credibility.

Lenders and funding partners look for:

Proper formation

Consistent revenue

Organized financials

Predictable operations

Clear purpose for funds

This is why the Credit & Capital Pillar connects directly to Business Formation & Systems. Capital flows to businesses that look like they can handle it.

Capital Is a Multiplier, Not a Lifeline

Capital should amplify what already works — not save what’s broken.

Using funding to:

Cover recurring losses

Fix poor pricing

Patch disorganized operations

…creates deeper problems.

Strategic capital use looks like:

Expanding proven marketing

Hiring to relieve bottlenecks

Purchasing equipment that increases capacity

Improving infrastructure

Entering new markets intentionally

Capital multiplies discipline. It exposes lack of it.

Emotional vs Strategic Financial Decisions

Entrepreneurs often make financial decisions emotionally:

Out of fear

Out of urgency

Out of ego

Out of desperation

Scaling requires detachment.

Strategic entrepreneurs ask:

What’s the ROI?

What risk does this reduce?

What capacity does this create?

How does this affect cash flow?

They don’t avoid leverage — they respect it.

Cash Flow Is the Real Scorecard

Profit is important, but cash flow is survival.

Leverage must support:

Predictable inflows

Manageable outflows

Cushion for uncertainty

Scaling entrepreneurs plan funding around:

Payment cycles

Revenue timing

Seasonal fluctuations

Operational costs

Credit & capital are tools to smooth cash flow — not strain it.

Building Capital Readiness

Capital readiness means being prepared before funding is needed.

This includes:

Clean books

Clear use-of-funds plans

Business credit development

Relationships with lenders

Awareness of funding options

Waiting until money is needed is too late. Readiness creates optionality.

How Credit & Capital Support Long-Term Scale

When used correctly, leverage:

Reduces stress

Increases speed

Improves negotiation power

Supports growth without burnout

Preserves ownership and control

Scaling entrepreneurs don’t fear capital — they plan for it.

Conclusion: Leverage Is a Leadership Skill

Scaling a business without leverage is like trying to build a house with only your hands.

Credit & Capital are not shortcuts — they are tools. When used responsibly, they allow entrepreneurs to grow beyond personal limitations without sacrificing stability.

In the Real Life XP framework, this pillar ensures that growth is funded with intention, supported by structure, and aligned with long-term sustainability.

Scaling isn’t about spending more — it’s about accessing more intelligently.

Scaling With Leverage: How Credit & Capital Fuel Growth Without Killing Cash Flow

Introduction: Growth Slows When You Rely Only on Cash

One of the biggest myths in entrepreneurship is that the safest way to grow is to use only your own money.

While bootstrapping can work in the beginning, it becomes a silent ceiling as the business grows. Cash-only growth forces entrepreneurs to choose between opportunities, delay expansion, and absorb risk personally.

👉 Scaling requires leverage — and leverage requires access to capital.

In the Real Life XP framework, the Credit & Capital Pillar exists to help entrepreneurs grow strategically, not emotionally. This pillar is about learning how to use financial tools correctly so growth accelerates without destabilizing cash flow or increasing personal stress.

The Difference Between Revenue and Leverage

Revenue is what your business earns.

Leverage is what your business can access.

Many entrepreneurs generate revenue but lack leverage. When opportunities arise — larger contracts, bulk inventory, marketing pushes, hiring needs — they don’t have the capital to move quickly.

Without leverage:

Growth is slow

Decisions are reactive

Cash flow stays tight

Risk is concentrated on the owner

Leverage allows businesses to act before cash shows up — not after.

Why Self-Funding Becomes a Scaling Problem

Self-funding feels responsible. It avoids debt and feels “safe.”

But in reality:

It limits speed

It drains reserves

It increases personal risk

It forces trade-offs that stall momentum

Scaling entrepreneurs understand that cash is a tool, not a moral position. The goal isn’t to avoid credit — it’s to use it intelligently.

Business Credit vs Personal Credit

One of the most common mistakes entrepreneurs make is funding business growth with personal credit.

This leads to:

Higher personal risk

Lower personal credit scores

Limited funding capacity

Blurred financial boundaries

Business credit creates separation.

Properly built business credit:

Protects personal assets

Increases funding limits

Builds business credibility

Unlocks better terms over time

Scaling requires treating the business as its own financial entity.

Why Banks Don’t Fund Chaos

Access to capital is not just about credit scores — it’s about credibility.

Lenders and funding partners look for:

Proper formation

Consistent revenue

Organized financials

Predictable operations

Clear purpose for funds

This is why the Credit & Capital Pillar connects directly to Business Formation & Systems. Capital flows to businesses that look like they can handle it.

Capital Is a Multiplier, Not a Lifeline

Capital should amplify what already works — not save what’s broken.

Using funding to:

Cover recurring losses

Fix poor pricing

Patch disorganized operations

…creates deeper problems.

Strategic capital use looks like:

Expanding proven marketing

Hiring to relieve bottlenecks

Purchasing equipment that increases capacity

Improving infrastructure

Entering new markets intentionally

Capital multiplies discipline. It exposes lack of it.

Emotional vs Strategic Financial Decisions

Entrepreneurs often make financial decisions emotionally:

Out of fear

Out of urgency

Out of ego

Out of desperation

Scaling requires detachment.

Strategic entrepreneurs ask:

What’s the ROI?

What risk does this reduce?

What capacity does this create?

How does this affect cash flow?

They don’t avoid leverage — they respect it.

Cash Flow Is the Real Scorecard

Profit is important, but cash flow is survival.

Leverage must support:

Predictable inflows

Manageable outflows

Cushion for uncertainty

Scaling entrepreneurs plan funding around:

Payment cycles

Revenue timing

Seasonal fluctuations

Operational costs

Credit & capital are tools to smooth cash flow — not strain it.

Building Capital Readiness

Capital readiness means being prepared before funding is needed.

This includes:

Clean books

Clear use-of-funds plans

Business credit development

Relationships with lenders

Awareness of funding options

Waiting until money is needed is too late. Readiness creates optionality.

How Credit & Capital Support Long-Term Scale

When used correctly, leverage:

Reduces stress

Increases speed

Improves negotiation power

Supports growth without burnout

Preserves ownership and control

Scaling entrepreneurs don’t fear capital — they plan for it.

Conclusion: Leverage Is a Leadership Skill

Scaling a business without leverage is like trying to build a house with only your hands.

Credit & Capital are not shortcuts — they are tools. When used responsibly, they allow entrepreneurs to grow beyond personal limitations without sacrificing stability.

In the Real Life XP framework, this pillar ensures that growth is funded with intention, supported by structure, and aligned with long-term sustainability.

Scaling isn’t about spending more — it’s about accessing more intelligently.

What are the benefits of business coaching?

Business coaches help entrepreneurs develop within their personal and business lives, so their businesses can thrive.

This includes identifying strengths and weaknesses, setting personal and professional goals and targets, and holding

the entrepreneur accountable to ensure those goals are reached.

What is Real Life XP?

Real Life XP is our free entrepreneur acceleration course, available in the Real Life Business Builders community. The

three modules in the course focuses first on the entrepreneur mindset, then business systems and processes, and finally building business credit and obtaining business financing.

This course is desgned to help entrepreneurs of all levels.

What is The Real Life Business Builder?

The Real Life Business Builder is an all-in-one CRM and marketing system that we help implement for entrepreneurs to build their contact list and nurture relationships with leads and customers. The system includes a website/funnel builder, email and SMS marketing and the option to brand the software as your own and resale it for profit. With a price as low as $80 per month, you have more than enough room to spend money on ads, which we will also run for you, if need be.

What else do you offer?

Real Life Business Solutions offers a wide range of products

and services, including eBooks, workbooks, courses, and other educational material as well as business plans, marketing plans, and specialized business solutions.

Is group coaching or 1-on-1 coaching available?

Yes, we offer different coaching programs to accommodate clients who enjoy building in a community and those who

are more comfortable in a more personal setting.

Is there some type of guarantee?

Yes. Real Life Business Solutions provides more than enough tools and resources to help entrepreneurs grow into who they need to become to be successful, but doing the work is still up to the client. While we can't guarantee specific results, we can guarantee that we will provide all of the things we promise or you will receive all of your money back.

Do I have to own a business to join the Real Life Business Builder Community?

No. The Real Life Business Builder Community is designed to help entrepreneurs and aspiring entrepreneurs. As long as you are interested in business and business conversations, the community will be of value to you.

Why are there no prices on the website?

Due to the unique nature of every person and every business, consulting prices cannot be quoted until we have our initial strategy session. We offer some programs, with prices, to offer

a starting point, but any personalization will require direct communication before a proposal is drawn up.

What are the benefits of business coaching?

Business coaches help entrepreneurs develop within their personal and business lives, so their businesses can thrive.

This includes identifying strengths and weaknesses, setting personal and professional goals and targets, and holding

the entrepreneur accountable to ensure those goals are reached.

What is Real Life XP?

Real Life XP is our free entrepreneur acceleration course, available in the Real Life Business Builders community. The

three modules in the course focuses first on the entrepreneur mindset, then business systems and processes, and finally building business credit and obtaining business financing.

This course is desgned to help entrepreneurs of all levels.

What is The Real Life Business Builder?

The Real Life Business Builder is an all-in-one CRM and marketing system that we help implement for entrepreneurs to build their contact list and nurture relationships with leads and customers. The system includes a website/funnel builder, email and SMS marketing and the option to brand the software as your own and resale it for profit. With a price as low as $80 per month, you have more than enough room to spend money on ads, which we will also run for you, if need be.

What else do you offer?

Real Life Business Solutions offers a wide range of products and services, including eBooks, workbooks, courses, and other educational material as well as business plans, marketing plans, and specialized business solutions.

Is group coaching or 1-on-1 coaching available?

Yes, we offer different coaching programs to accomodate coaches who enjoy building in a community and those who

are more comfortable in a more personal setting.

Is there some type of guarantee?

Yes. Real Life Business Solutions provides more than enough tools and resources to help entrepreneurs grow into who they need to become to be successful, but doing the work is still up to the client. While we can't guarantee specific results, we can guarantee that we will provide all of the things we promise or you will receive all of your money back.

Do I have to own a business to join the Real Life Business Builder Community?

No. The Real Life Business Builder Community is designed to help entrepreneurs and aspiring entrepreneurs. As long as you are interested in business and business conversations, the community will be of value to you.

Why are there no prices on the website?

Due to the unique nature of every person and

every business, consulting prices cannot be quoted

until we have our initial strategy session. We offer

some programs, with prices, to offer a starting

point, but any personalization will require direct communication before a proposal is drawn up.

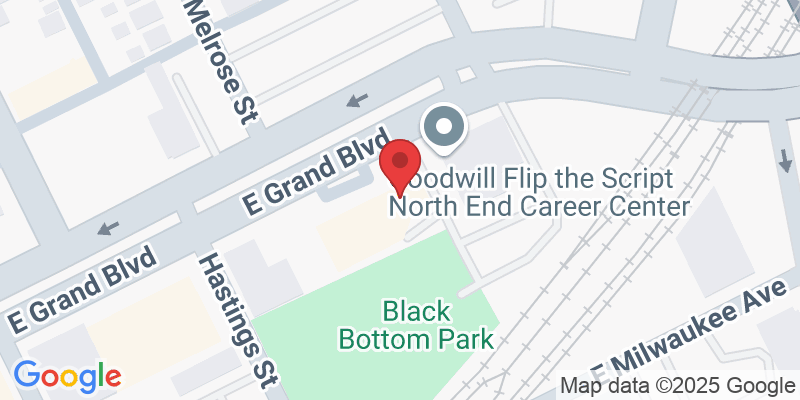

Contact Us

(313) 883-9664

Real Life Business Solutions

2785 E Grand Blvd, Suite 381

Detroit, MI 48211

© 2024 Real Life Business Solutions, LLC - All Rights Reserved · Privacy policy

Contact Us

(313) 883-9664

Real Life Business Solutions 2785 E

Grand Blvd, Suite 381Detroit, MI 48211

© 2024 Real Life Business Solutions, LLC -

All Rights Reserved · Privacy policy